We have noticed an unusual activity from your IP 2074613135 and blocked access to this website. Tax payable under an assessment upon submission of a tax return is due and payable by the last day of the seventh month from the date of closing of accounts.

Project On E Filing Income Tax Return Online Pdf Capital Gains Tax Income Tax In India

Employment income e-BE on or before 15 th May.

. Grace period is given until 15 May 2019 for the e-Filing of Form BE Form e-BE for Year. Employers who have e-Data Praisi need not complete and furnish CP8D. 31 March 20 a Form E will only be considered complete if CP8D is submitted on or before 31 March 2020.

Click on Permohonan or Application depending on your chosen language. Deceased persons estate Association. The due date for submission of the REITs RF.

Thus the new deadline for filing your income tax returns in Malaysia via e-Filing is 30 June 2020 for resident individuals who do not carry on a business and 30 August 2020 for. Corporate income tax CIT due dates - PwC. The deadline for filing income tax in Malaysia is 30 April 2019 for manual filing and.

Employment income BE Form on or before 30 th April. This option may vary depending on what type of income tax you are filing and you can refer to this table to help you figure out what to look for. Investment trust REIT ends on 31 May 2019.

B Failure to furnish Form E on or before 31 March 2020 is an offence under paragraph 1201b of the Income Tax Act 1967 ITA 1967. Late Fees. E-filing or online filing of tax returns via the Internet is available.

Internet Explorer 110 Microsoft Edge Mozilla Firefox 440 Google Chrome 460 atau Safari 5. Microsoft Windows 81 service pack terkini Linux atau Macintosh. BE FORM DUE DATE EXTENSION TIME Manual Form 15 MAY 2020 30 APRIL 2020 30 JUNE 2020 30 JUNE 2020.

E-filing is encouraged by the Inland Revenue Board. Sukacita dimaklumkan bahawa Lembaga Hasil Dalam Negeri Malaysia HASiL akan menganjurkan Seminar Percukaian Kebangsaan SPK 2022 secara dalam talian webinar. Pengesahan ini boleh didapati melalui perkhidmatan ezHASiL di httpsezhasilgovmy atau di cawangan-cawangan LHDNM.

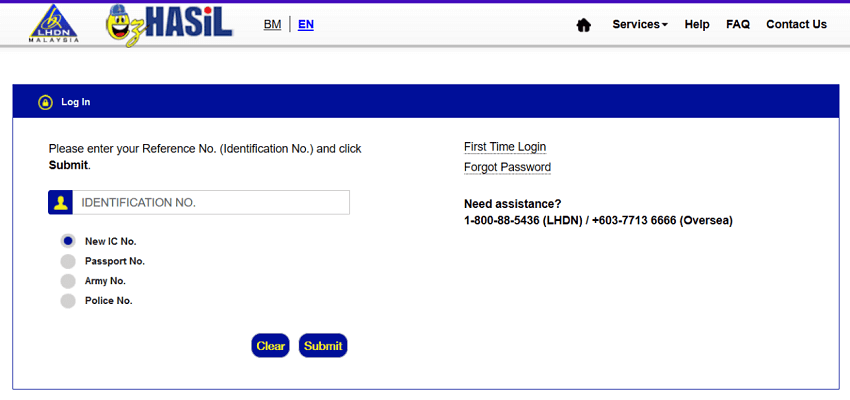

Date and Time of the incident eg when the sexually abusive video was uploaded on social media Platform where the incident occurred WhatsApp Facebook Instagram etc Upload. By 30 April without business income or 30. 4 2 3 4 e-Filing 1 Easy Steps of Get your PIN No.

Download a copy of the form and fill in your details. FOR 2019 FOR 2019 TAX RELIEF FOR 2019 TAX RELIEF FOR 2019 TAX RELIEF FOR 2019 SOCSO BASIC. How Does Monthly Tax Deduction Work In.

And register for Digital Certificate Login and Complete Online Form e-BE. E filing due date 2018 malaysia BE FORM DUE DATE EXTENSION TIME Manual Form 15 MAY 2020 30 APRIL 2020 30 JUNE 2020 30 JUNE 2020. By 31 March of the following year.

E filing due date 2019 malaysia Tax Relief Ya 2021 9 Things You Should Know When Doing E Filing In 2022 Irs Releases Final Gilti Regulations Grant Thornton. Form E Return by Employer Individual income tax return No business income With business income Statutory deadline March 31 2020 April 30 2020 June 30 2020 Existing grace period -. Go back to the previous page and click on Next.

Other entities Submission of income tax return. Once the new page has loaded click on the relevant income tax form for the year. E filing due date 2019 malaysia.

Business income B Form on or before 30 th June. Click on the menu ezHasil services menu on the left-hand side of the screen then select e-filing. Click on e-Filing PIN Number Application on the left and then click on Form CP55D.

Requirement of HSN Code is mandatory wef. Dimaklumkan bahawa pembayar cukai yang pertama kali. 1 Due date to furnish this form.

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

As Per The Changed Rules Notified Under Section 234f Of The Income Tax Act Which Came Into Effect From April 1 2017 Income Tax Filing Taxes Income Tax Return

List Of Income Tax Relief For Lhdn E Filing 2022 Ya 2021 Iproperty Com My

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

Change Reset Income Tax E Filing Password In Just 2 Minutes Forgot Itr Login Password Youtube

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

Ctos Lhdn E Filing Guide For Clueless Employees

A Complete Guide For A Taxpayer On E Filing Of Income Tax Return

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

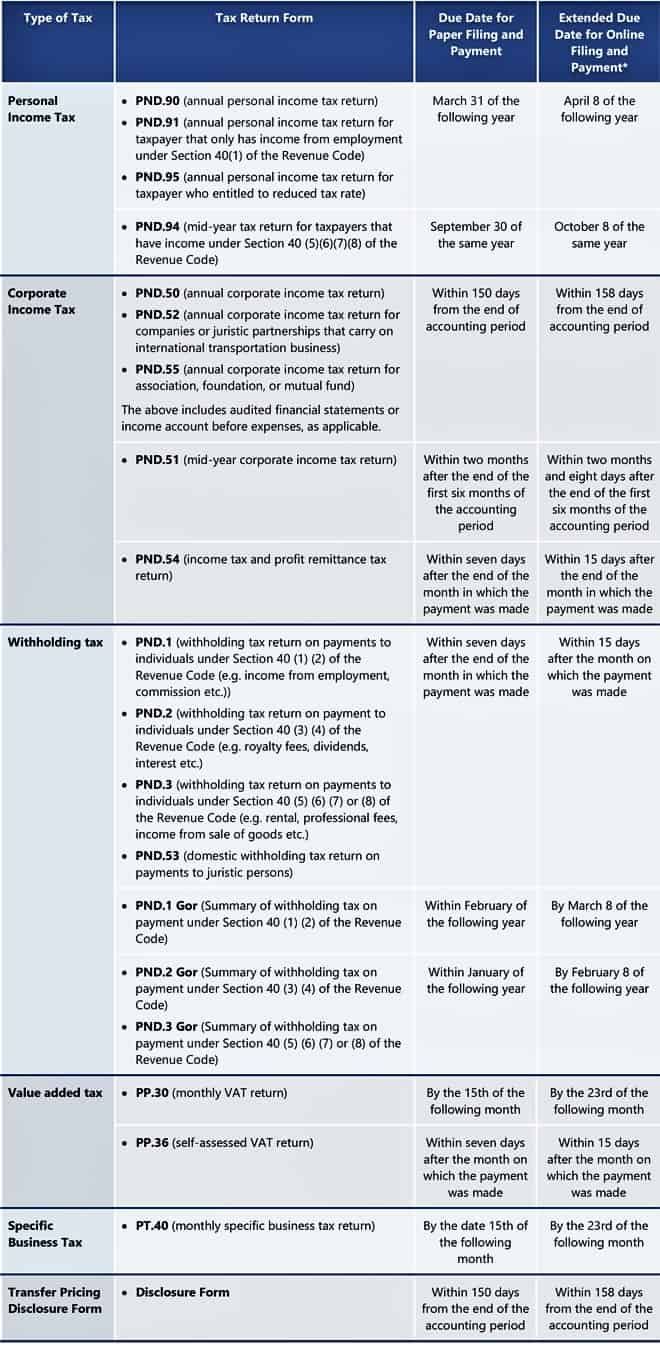

Further Extension For E Tax Filing And Payment In Thailand Income Tax Thailand

Pdf E Filing Acceptance By The Individual Taxpayers A Preliminary Analysis

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

The Irs Made Me File A Paper Return Then Lost It

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Pdf Tax E Filing Adoption In Malaysia A Conceptual Model

Ctos Lhdn E Filing Guide For Clueless Employees

Cbdt Enabled Various E Filing Statutory Forms On The Income Tax E Filing Portal A2z Taxcorp Llp

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa